Archive

Money Is Not Safe In The Big Banks

People think that money is safe in the big banks because the FDIC will protect the deposits. This assumption is not based on the facts. This video will show official government documents that describe the plans for confiscating deposits when, (not if) a big bank fails. Individual, as well as public funds from municipal, university, county deposits are at serious risk. YOUR taxpayer money will disappear in the next crisis! Public officials in charge of taxpayer funds need to be aware of the dangers here. The loss of taxpayer funds and the inability to meet payrolls and obligations will certainly prompt a response that will both immediate and forceful.

This video will show how Cyprus was not a one-time event and how the Cyprus confiscation was planned well in advance and how M.F. Global was the blueprint for future confiscations and how a legal precedent was created when these losses were upheld by the legal system.

Ask your public official in charge of finance where they keep YOUR taxpayer money!

Ask them if they have researched the public banking option! Do not accept no for an answer, ask them why. If they say that you do not understand these things, tell them to explain it to you.

After all, this is your money that you worked so hard for, so don’t let the big gamblers from Wall Street use YOUR personal or taxpayer money to cover THEIR losses. These big bankers are money addicts, they have no appreciation of how much work went into making that money. They do not care about you or your money, all they care about is their addiction. Don’t let public officials continue to put your taxpayer money at risk with these gamblers, just because this is how it has been done in the past.

How Many Warnings Do You Need?

How Many Warnings Do You Need?

If you knew someone with a gambling problem, you probably would not give them your money to hold. If you knew that they had placed bets that were 30 to 70 times more than the amount of money they had, you would certainly consider them totally reckless. If you knew that the money they were holding and betting with was with borrowed money, other peoples’ money not their own, you would probably conclude that they are hopelessly addicted to money. Remember these thoughts as you continue to read this article.

Picture these scenarios:

1. You go to buy groceries and when you use your credit or debit card the transaction is denied despite the fact you have money in your account.

2. You are a public official, such as a school business administrator, county treasurer, municipal finance manager, pension fund administrator, or anyone who has responsibility for protecting public money. You try to access the money and the transaction is denied.

Under either scenario, you investigate why you cannot access money you know is in your account and you find out that the bank has failed and has been closed until further notice by the authorities. You also discover that the government will be confiscating part of your savings in order to “stabilize” the bank.

So you think that “cannot happen here”? You think you are safe because the FDIC “protects” your money? You placed your money into one of the big banks and believe it is safe because it has large vaults and is insured by the government. Perhaps you placed the public monies you are charged with into a large bank because they are properly “collateralized” and therefore you believe these funds are safe. If you truly believe any these previous statements, you really need to read the rest of this article because your money is at serious risk.

So you think your money is safe? Let’s examine why that assumption could cost you all or part of your savings. Would you be surprised to learn that money sitting in everyday peoples’ savings accounts in Cyprus was confiscated in order to “stabilize” the banks? If you are surprised by this news, hopefully this article will provide you with an incentive to do some research. This article is filled with links to more information, and I encourage you to follow them. If you are aware of this bank confiscation, do not make the mistake of believing that it is an isolated event that “cannot happen here”.

In a nutshell, what actually happened in Cyprus was that the banks were overleveraged and the size of the liabilities of the banks exceeded the Gross Domestic Product (GDP) of the entire country of Cyprus. Given the fact that the “bail outs” of the large banks in 2008 were so politically unpopular, the European “troika” imposed a “bail in”, where customers with savings accounts were to have some of their savings seized (read: stolen) in order to stabilize the banks. The losses to some accounts were as high as 60%. The banks were closed for 12 days, so people had no access to their money and once the banks reopened, they had only limited access to their money in order to protect the banks.

Was this plan by the “troika”, just a one-time event or was this something more? It turns out that this eventuality had actually been planned in advance in 2012 at the G20 Financial Stability Board in Basel Switzerland where the US FDIC and the Bank of England created a joint paper outlining a confiscation scheme. Under the FDIC/BOE joint paper, accounts of $250,000 or less could be seized by the failing bank and converted to stock equity as part of a “bail in” scheme. The stock would of course be essentially worthless because the bank has already failed.

There is also a plan to confiscate savings in New Zealand if necessary to save the banks. Canada also has a confiscation plan in the wings should their banks falter. The European Union has just reached an agreement where shareholders and depositors will be tapped to “bail in” any bank in trouble.

So you still think that this “cannot happen here” because the FDIC will protect your money? Consider that our largest banks have derivative contracts with a notional value of more than $700 trillion (think $700,000 BILLION!). The entire world GDP is only $70 trillion, therefore the liabilities of the big banks could not be covered by the entire GDP of the United States. Does this sound similar to what happened in Cyprus? Does this sound similar to the gambler at the beginning of this article? What is very important to keep in mind is that Cyprus is a small country and that much larger outside forces came in to “stabilize” the banks. If one (or more) of the large U.S. banks experiences a derivative failure, there is not enough money on the planet to “stabilize” them.

These derivatives are really nothing more than “bets” placed by the banks, and when (not if) these “bets” start going bad, the banks will be on the hook for their value. You need to know that these derivative “bets” have been given super-priority status in case of a bank bankruptcy. What this means is that the holders of these derivative contracts will have first priority for payment and that you either as an individual or government entity will be placed at the back of line – as a bank creditor should a large bank fail. This means that you will probably get little or nothing back. Most people do not understand that once you give a bank your money, the money legally is no longer yours. Under the law, you are an unsecured creditor to the bank and are treated as such in any bankruptcy proceeding. As an individual or as a public official, if you have money in one of the big banks, you have essentially given your money to that gambler and now you are a creditor to the gambler.

This sort of loss has already happened with the MF Global collapse. While this was a futures trading company and not a bank, the blueprint for confiscations was tested here and with the Sentinel case the legal system upheld the customer losses. These trading accounts were supposed to be “segregated” accounts that belonged to the account holders, not MF Global. As an analogy, think of a “segregated” account as a safe deposit box at a bank, the contents belong to you, not the bank. Yet in the MF Global collapse, in this analogy it essentially gambled with the assets in the customers’ safe deposit boxes, and the legal system placed the creditors of the bank above the safe deposit box holders.

Still think the FDIC will protect the derivative and account holders? JP Morgan Chase has $1.1 trillion ($1,100 Billion!) in deposits and Bank of America also has over $1 trillion ($1000 Billion!). Again, remember that gambler, JP Morgan Chase has about $70 TRILLION in bets out there, but is holding only about $1 Trillion in deposits and another Trillion in assets. It has made bets with a value approximately 35 times all the money it has access to. Again, this is YOUR money they are betting with, not their money. Bank of America also has about 30 times its assets in derivative bets. Citigroup and Wells Fargo each have over $900 billion each in deposits and also have many times their assets in derivative bets. Once these bets start going bad, there is no way the banks can cover them. The FDIC has only $33 billion available to insure deposits. That means that once any one of these banks fails, the FDIC has less than 3% of the money needed to cover the depositors. If any one of these big banks fails, these banks are so interconnected that it is also likely to bring down the other large banks. In fact both Bank of America and JP Morgan Chase have moved their riskiest derivatives from their uninsured trading houses to the FDIC insured subsidiaries, which are their retail banks, putting the funds in those accounts at a significantly increased risk. Once even one of these biggest banks experiences a derivative meltdown, there is not enough money in the FDIC or probably even the U.S. Treasury to cover the losses. Still think Cyprus cannot happen to you?

If you are a public official who has responsibility for protecting public money, you probably have that money deposited into an account with one of the largest banks. Do you still believe that money is safe? Are you doing your fiduciary duty to protect that money in the public interest? So as a government official in charge of finances, what are your options?

One option is to start a public bank such as the Bank of North Dakota. First public banks do not gamble with derivatives and the Bank of North Dakota thrived during the crisis of 2008. Not only will you get the safety of the money for which you have responsibility for, but other advantages to this approach include: the ability to provide interest free or low interest loans for public infrastructure projects, the ability to create jobs, generate revenue, and build up the local community. This article clearly explains some of the huge advantages of financing your projects using a public bank.

Consider this – if you buy a home for $100,000, by the time you have paid the mortgage in full, the total cost will have been close to $300,000. Consider the absurdity of paying those who build the home and provide the raw materials $100,000, and paying the financiers $200,000 for money that was not even theirs. This makes little sense. The same principle applies if a state, county, or municipality wants to build a road, school, bridge, or other infrastructure. They need to go to Wall Street for financing at high interest rates. However they could form their own bank and finance the project at zero or near zero interest. The projects would cost less than half and the finance costs would not be siphoned out of the community, impoverishing it, and ending up on Wall Street or in Cayman Island tax shelters. The finance costs would stay in the community.

Think of the things that could be accomplished if you could eliminate debt service as a line item in your budget! The money deposited in the public bank would be safe and would serve the local community. You could use the public bank to refinance existing debt at zero or near zero percent interest. You could lower tax rates! This idea has such appeal that currently there are initiatives in 20 states to start public banks.

If you are a public official with a fiduciary responsibility to protect public funds and one of these large banks fails and you lose the public money, think of the consequences that will arise once the public becomes aware that you did not heed the warnings that Cyprus provided. Think of the consequences that will arise when the public becomes aware that you did not consider alternatives to the big vulnerable banks. It is time to bring home the money from Wall Street where it is at risk. If there is a derivative crash, try meeting your payroll with stock equity (in a failed bank). The impact of not meeting a payroll will be both immediate and forceful. It is vital to get that money out of Wall Street BEFORE the next meltdown.

If you are a public official with a fiduciary responsibility to protect public funds and one of these large banks fails and you lose the public money, think of the consequences that will arise once the public becomes aware that you did not heed the warnings that Cyprus provided. Think of the consequences that will arise when the public becomes aware that you did not consider alternatives to the big vulnerable banks. It is time to bring home the money from Wall Street where it is at risk. If there is a derivative crash, try meeting your payroll with stock equity (in a failed bank). The impact of not meeting a payroll will be both immediate and forceful. It is vital to get that money out of Wall Street BEFORE the next meltdown.

To those public officials who are truly interested in serving their communities, this is your moment. This is your time to step up to the plate. Be bold, be innovative, and empower your communities. You owe this to your fellow citizens, your children and your future. Visit this website to learn more about the possibilities that public banking offers, to learn how to get started, and where to find help in implementation. You are not alone of you wish to make this happen.

If you are an individual saver who wants to protect your money, you need to move your money out of the big banks because that is where it is most vulnerable. Move your money into local community banks or Credit Unions. This will help your local banks as well as your community by keeping the money local. It is also important to MOVE YOUR DEBT to these local banks as well. The way bank accounting works, a deposit is actually considered a liability to the bank, while a loan is an asset on its accounting ledger. (I know this sounds convoluted, but this is the way it is). By moving your debt to the local banks, you create assets for them as well as helping your local community. While there are no guarantees that a smaller bank could survive the crash of one or more of the bigger banks, very few of the small banks have gambled with the super-priority derivatives. This is huge advantage that at provides insulation from the large banks.

So, consider yourself warned, money is not safe in the big banks. The MF Global losses, the Cyprus confiscations, the Sentinel case, the FDIC/BOE Joint Paper, the plans in the European Union, Canada, New Zealand, and Spain to raid private accounts, and finally the information in this article should be raising all sorts of red flags. HOW MANY WARNINGS DO YOU NEED? Personal accounts, as well as any school, municipal, county, and state funds that are deposited in any of the big banks are not safe. The plans for confiscation have already been developed, they have been approved, they are awaiting the next crisis.

Ask your public official in charge of finance where they keep YOUR taxpayer money!

Ask them if they have researched the public banking option! Do not accept no for an answer, ask them why. If they say that you do not understand these things, tell them to explain it to you.

After all, this is your money that you worked so hard for, so don’t let the big gamblers from Wall Street use YOUR personal or taxpayer money to cover THEIR losses. These big bankers are money addicts, they have no appreciation of how much work went into making that money. They do not care about you or your money, all they care about is their addiction. Don’t let public officials continue to put your taxpayer money at risk with these gamblers, just because this is how it has been done in the past.

The Money Masters Live in Fear

“Whoever controls the volume of money in our country is absolute master of all industry and commerce…and when you realize that the entire system is very easily controlled, one way or another, by few powerful men at the top, you will not have to be told how periods of inflation and depression originate.” – President James Garfield, 2 weeks before his assassination.

Most people in the United States have long suspected that a “shadow government” exists and that the real power in the country resides in that dark location, not in our elected government. The citizens instinctively know that our elected officials are really nothing more than the hired servants of the money masters and are beholden to them if they wish to retain their positions of power.

A quick look at the curtain which they hide behind reveals one shadowy organization that represents the interests of these money masters, the International Swaps and Derivatives Association also known as ISDA. The officers and directors of this organization include some of the largest hedge funds and most of the major banks in the world including the largest banks in the United States. One of the purposes of the ISDA is determine if a “credit event” is actually a default. If a “credit event” is declared to be a default, then Credit Default Swap (CDS) contracts come into play.

Most people have heard of Credit Default Swaps and derivatives, but are not quite sure of what they really are. Before I can continue with this article, I will present a short description of these two financial instruments. Please bear with me on this as things will get interesting shortly.

Credit Default Swaps (CDS) can be generally considered to be insurance policies issued by banks (sellers) and taken out by investors (buyers) to protect against failure among their investments. The problem with them is that while insurance companies are regulated to make sure that the companies have the ability to pay their claims, the CDS issued by the bankers are largely unregulated.

Derivatives are financial instrument whose value is based on the value of another financial instrument. If one looked at a football team: it owns the stadium, has contracts with players, has advertising rights, has television contracts etc. Each one of these is an economic entity capable of generating income. Derivatives could be considered the bets that people place on these teams. (Credit Default Swaps are a form of derivatives).

So what do derivatives and Credit Default Swaps have to do with all this, how do they affect people on the street, and why are the money masters so concerned about them?

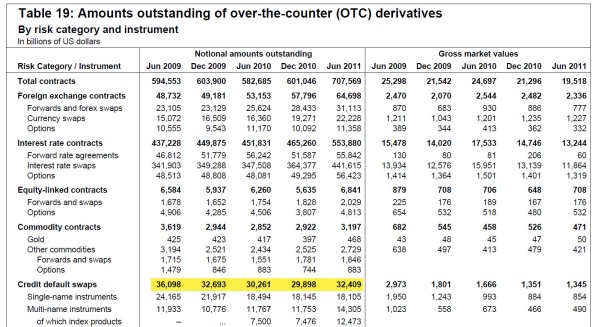

Take a look at the ,following table in a report created by the Bank of International Settlements.

If you look at the highlighted area, you will see that the total value of Credit Default Swaps for 2011 is a staggering $32,409 BILLION dollars! That is $32 TRILLION, with a “T”! To put this into perspective the gross domestic product (GDP) of the United States in 2010 — the total value of all the goods and services generated in the entire country that year — was $14.6 trillion. The amount of credit default swaps held by the banks dwarfs the entire economic output of the United States. There is no way in hell that these banks could ever pay even a small fraction of these claims. The TOTAL amounts of derivatives is a staggering $707 TRILLION plus a measly few hundred billion more. This entire system is a house of cards just waiting for a single card to fall. There is not enough money on this planet to cover these contracts.

A report by the Comptroller of the Currency has the nation’s five largest banks — JPMorgan Chase, Citigroup, Bank of America, HSBC, and Goldman Sachs — holding nearly 95 percent of the industry’s total exposure to derivatives contracts. This means the 5 largest banks are on the hook for over $30,000 billion for just the CDS they issued.

This is where it starts to get interesting.

Remember earlier in this article I stated that one of the purposes of the ISDA is to determine if a “credit event” is actually a default? If a “credit event” is declared to be a default, then Credit Default Swap (CDS) contracts come into play. Think about this, the very same banks that would have to pay the claims by those who bought these contracts, are in the position of determining if a “credit event” is really a default. All the banks have to do is to NOT declare any default and they do not have to pay! If they did have to pay, and then the house of cards would collapse. The big banks would immediately be insolvent and the money masters live in fear of this.

This lack of a declared default by the ISDA is exactly what brought down MF Global which was speculating heavily on European bonds. What ultimately happened was that an agreement was reached in Europe that that investors would have to take a write-down of 50% on Greek Bond debt. Now MF Global was leveraged anywhere from 40 to 1, to 80 to 1 depending on whose figures you believe. Let’s assume that MF Global was leveraged 40 to 1, this means that they could not even absorb a small 3% loss, so when the “haircut” of 50% was agreed to, MF Global was finished. It tried to stem its losses by criminally dipping into segregated client accounts, and we all know how that ended with clients losing their money.

MF Global may well be just the tip of the iceberg on what still awaits us.

However, MF Global thought that they had risk-free speculation because they had bought these CDS from these big banks to protect themselves in case their bets on European Debt went bad. MF Global should have been protected by its CDS, but since the ISDA would not declare the Greek “credit event” to be a default, MF Global could not cover its losses, causing its collapse.

Think about this for a minute, if you or I paid 50% of our mortgage payment, this would certainly be declared a default. However, in the Greek bond write-down the ISDA did not declare it a default. What you essentially have here is a situation where the banks controlling the ISDA and are essentially determining their own fate.

Now with the talk in Europe being that investors may have to take a write down of 70% on some European debt, will that be declared a default? I doubt it, again because that would drive the 5 biggest banks in the United States into insolvency. The problem becomes, at what point does the ISDA declare a default? At 70%, at 80% , or at 100% if Greece or another country just walk away from their debt? Once a default is declared by the ISDA, the banks are done, and the money masters know this! The conflict of interest in this situation is clear. These banks got to write the insurance , get paid the premiums and yet they have total control over whether they will have to pay.

The money made by selling these derivatives is directly responsible for the huge profits and bonuses we now see on Wall Street. The money masters have reaped obscene profits from this scheme, but now they live in fear that it will all unravel and the gravy train will end. What these banks have done is to leverage the system to such an extreme, that the entire house of cards is threatened by a small country of only 11 million people. Greece could bring the entire world economy down. If a default was declared, the resulting payouts would start a chain reaction that would cause widespread worldwide bank failures making the Lehman collapse look small by comparison.

The ability of these large banks to not pay on the Credit Default Swaps that they wrote, sold and profited from is a travesty. What will happen once other countries like Italy, Spain, and France have bond write downs? This criminal abrogation of contracts exposes something much bigger, the unregulated shadow banking system of derivatives. The Dodd-Frank bill that people thought would regulate the finance industry does little to address the problems of derivatives, largely due to the money masters’ lobbyists that influenced the bought politicians to not put limits on the gravy train. We have a system where: laws are written by the servants of the money masters, the regulators are appointed by these same servants, CDS policies were written by the money masters, premiums were paid to the money masters, fees were taken by the money masters , but no payouts will be permitted by the money masters. Do not expect the paid politicians or regulators to do anything about this.

These titans of Wall Street do not answer to any government or to the public. They have set us all up for a second financial crisis far worse than in 2008. These money masters are humanity’s worst enemy. This is another example of a paper game they have created to enrich themselves, but puts the entire world at risk.

Well, these Masters of the World will be having a themselves a get-together to plan the future of their world.

*The ISDA 27th Annual General Meeting will be held on April 30-May 2, 2012 in Chicago.

*This will be followed by the G8 summit meeting in Chicago on May 19 and May 20.

*Then this will be followed by the NATO summit in Chicago on May 20 and May 21.

During 9-11, it was said that our security services failed to connect the dots. However, here we have a situation where if you analyze this carefully, it is easy to connect the dots.

There is a reason that the ISDA meetings are held first. The G8 and NATO events are the window dressing for public consumption. The real decisions will be made by the money masters so their meeting needed to be held first. At this meeting, the money masters will develop their marching orders for their puppets, the paid servants who are the political leaders who will be in attendance at the G8 conference.

These puppets at the G8 Conference will then create the marching orders for the militaries that they control. However, all the “big picture” planning will have been developed at the ISDA meetings. The money masters live in fear of an economic collapse that they have brought about and they may have need of a military adventure to distract the masses from their crimes. Of course the paid servants will go along with this plan because they do not want to do anything that would change their positions of power. Watch for signs of a bogeyman country orchestrated by the mass media to whip up frenzy in support of war, or possibly even a false flag attack. This media campaign will be another symptom of the fear of the money masters.

The militaries will do what they always do and will blindly follow their orders. The NATO meeting will be used to develop the planning for the execution of the orders developed by the money masters.

With the continued austerity being imposed on the world by these bankers and their agencies such as the IMF, World Bank, and their hired servants our political leaders, a meeting of so many tools in one location is a natural magnet for protestors who are tired of the corruption and greed in the system. The demonstrators will be targeting the puppeteers, not just the puppets.

It is not difficult to imagine that the money masters do not want any of these meetings to be disrupted and that plans have already been made for an overwhelming police presence. There have already been reports of joint military exercises between the Los Angeles police and the military. You can count on the fact that the 1st Amendment will sustain “collateral damage”.

Chris Hedges, a Pulitzer prize winning journalist, has speculated that since the NDAA was opposed by the agencies in the national security establishment including the FBI, NSA, that what might be driving these military exercises is the fear that the bankers do not trust the police to protect them if things turn south.

“And I think, without question, the corporate elites understand that things, certainly economically, are about to get much worse. I think they’re worried about the Occupy movement expanding. And I think that, in the end—and this is a supposition—they don’t trust the police to protect them, and they want to be able to call in the Army.” – Chris Hedges

It is no mistake that Chicago was chosen for the site of these meetings. The powers that be know that the police will meet the protests with violence, but in Illinois, it is illegal to record the police. So the documentation of violence perpetrated in the protection of the interests of the money masters will be significantly reduced. The choice of Chicago for the site of these meetings is another example of the fear of the money masters.

The number and behavior of law enforcement as well as the myriad of other security agencies that will be present during these Chicago meetings will certainly be an indicator of the level of fear that the money masters are feeling as the world they have created on a foundation of theft, fraud, leverage and debt crumbles around them.

The Occupy Movement has been shining a light into the dark recesses that these money masters inhabit. The movement represents a real threat to their privileged positions as the public becomes more and more aware of the fraud and greed perpetrated by them, as they continue to extract even more money from the public. The money masters had their paid servants, the politicians evict the Occupiers from their parks in most cities across the United States. Another example of the fear the money masters have.

But…..

These money masters know now that all they accomplished was to scatter the movement which ultimately only strengthened it even more. The message is now quietly spreading to college campuses and to communities where foreclosures are being fought (further threatening the bottom lines of these same bankers). Every time that the hired politicians send their enforcers, the police to violently repress the movement, the movement grows in strength.

The money masters live in fear that they will not escape the blame for creating the next economic crisis as conditions continue to worsen. The money masters know that nothing has changed since the 2008 collapse and that the number of derivatives has actually grown since then (see chart). You would think that the bankers would have learned their lesson, instead with their myopic focus on their own wealth and greed the derivatives grew to significantly higher levels. These money masters now live in fear of the repercussions of these actions.

Eventually even the police will realize that their pensions are being raided by these money masters. The money masters have been manipulating their politician puppets to enact “pension reforms” that hide their theft in the name of “necessary cutbacks”. The money masters live in fear that ultimately even the police will refuse to protect their interests.

Eventually even the police will realize that their pensions are being raided by these money masters. The money masters have been manipulating their politician puppets to enact “pension reforms” that hide their theft in the name of “necessary cutbacks”. The money masters live in fear that ultimately even the police will refuse to protect their interests.

The money masters live in fear that the Occupy Movement will awaken the country from its deep sleep, and that the wrath of the people will turn against these sociopaths who have so manipulated the system in order to enrich themselves with no regard for anyone else. They may have their psychological and physical bunkers to hide in, but the very fact that they need these bunkers, shows their fear.

For more articles by many authors on economic, social, justice, media, and community issues:

http://www.endtheillusion.org