Community Part 1

Part 1: Gratitude

“Acknowledging the good that you already have in your life is the foundation for all abundance.”

Eckhart Tolle

If one could imagine what heaven would be like, it would be a place of infinite love, caring for all others, sharing of knowledge and enlightenment, and gratitude for all that they are given and have. There would be no fear because every soul would make sure that no one was wanting for anything they needed, there would be no theft since every soul would have everything they need, there would be no need for laws and enforcement, and there would be no need for money. This paradise would be the very essence of total efficiency because every soul cooperated to make certain that all needs were met. It would be a perfect community filled with love and free of fear.

One of the important elements in this vision is that of gratitude. Gratitude is a powerful force than can be harnessed to build the world we wish for. One key way to create gratitude is through GIFTING. If you think about it, our beautiful planet is a GIFT to all of life on earth and it was given freely. The warmth, energy, and life giving of the sun is a GIFT and is also given freely. When people receive gifts, there is an energy or spirit associated with that GIFT, and that energy or spirit also affects the giver. When we give a GIFT freely, we ourselves experience a sensation of well being and happiness. When we witness other people graciously giving GIFTS, we often become motivated to do the same. The very process of gift giving thus creates a force that has the potential to grow exponentially. A very special bond forms when a GIFT is given and these bonds have the potential to grow exponentially as well.

When people engage in barter or purchase, it is merely an accounting that takes place with something of accepted value flowing between both parties, but no gratitude is being generated. Charles Eisenstein wrote: “When we pay for everything we receive, we remain independent, disconnected, free from obligation, and free from ties.”i We have been conditioned by our culture to depend on no one and to be self sufficient all the time, yet these very acts separate us from others and thus weaken our connections to our communities. Rather than striving to be as independent as possible, a more positive goal would have us becoming more open to being interdependent to build the ties within our communities.

In contrast to barter or purchase, a gift elicits feelings of gratitude and a sense of wanting to reciprocate. In tribal societies there was little accounting of who owed what to whom, but there was much gift giving. A neighbor would care for the elderly, a hunter would share his food, a mother would care for the children of others, a healer would heal, people would cook for many, someone would create clothing, etc. These were all gifts and rarely did any of these actions include an accounting of something that was “owed”, but a great deal of gratitude was generated. Every time gratitude is generated, it adds to the positive energy in the universe. The desire to reciprocate is far more positive than an obligation to reciprocate, or to do an account balancing. This powerful potential energy of desire through gratitude can be harnessed in the process of creating positive communities.

Our culture tell us that competition creates the greatest efficiencies, yet if we look at nature as a model of efficiency, we can clearly see that cooperation is far more prevalent than competition, and it works better. Consider a human body, that most wondrous collection of cells, organs, and systems. The eyes do not compete with the ears, they cooperate to provide us with combined inputs to help us survive. The muscular system does not compete with the circulatory system or the digestive system, but they cooperate to provide the body with the nutrition and mobility it needs to survive and prosper. The blood cells do not compete with the skin cells, but instead care for, nourish, and protect each other in a marvelous symbiotic relationship of cooperation for the mutual good. On the biological level cooperation is the very basis for the success and efficiency of life on the planet whether it is a single cell organism or a complex one. Each living being is a thriving community.

On the social level, herds of grazing animals will cooperate to protect themselves and others from predators, individuals in lion prides without their own young will help with the raising and protection of the young of others, wolf packs will cooperate in the hunt, ants and bees cooperate for the good of the nest or hive, and geese cooperate by flying in the V formation and rotating the lead position. Should a goose become ill, wounded, or shot down, two of the geese will leave the formation and follow it down to help and protect it. All of these acts of cooperation help both the individual and the group to survive and thrive. There is saying I read once, “The better off others are, the better off we all are.”ii As life forms became more complex, it is often to their advantage to form cooperative social communities.

Of course there is also competition on the social level, such as for territory, for the finding of mates, or scarce food supplies, but it is not the competition as much as it is the cooperation that drives the success of nature. Much of the competition is for the benefit of the individual, rather than for the larger group.

Among humans, our best examples of local cooperative communities can be observed by examining small communities such as tribes. The members of the tribe work cooperatively for the benefit of all within the community and what benefits the larger tribe also benefits the individual. Each member is assigned a role to which he or she is well suited. Some may be the hunters, others may be the food preparers, others may be the teachers, others may be the healers, but each person has a role. No one is left out, even the elderly help raise the children of others if they are able or they may be the teachers. Those who are very disabled or can no longer contribute, are cared for by the tribe through the sharing of the common resources. This eliminates much of fear which brings about many of the symptoms of our current societies.

There is no individual homelessness or hunger unless it is affecting the entire tribe. If the hunters come back with food, it does not belong to the hunters, it is shared by all members of the tribe whether they directly participated in the hunt or not. Loneliness is derived from a lack of connection with those around us. In tribal life, with everyone being an active contributor to the community, connections are built and loneliness is reduced or eliminated.

Using nature as the model, thriving communities represent one of the most exciting areas where people can affect change, both personal and social. Communities can take many forms, they can be your local geographic location, or they can also be groups of people with common goals, interests, and beliefs that are not necessarily geographically linked. In upcoming posts, we will explore some examples of communities.

iEisenstein, Charles. Sacred Economics: Money, Gift, & Society in the Age of Transition. Berkeley, CA: Evolver Editions, 2011. Print. Pg 355

iiAtkins, Edward. On Which We Serve Part 2,. Vol. 2. West Bow Press, 2013. page 466

“Illusions Will Fall” ethereal rock opera songs compilation

The musical style for this opera is a blend of Pink Floyd, Enigma, and Enya.

Illusions Will Fall

Authorities in our lives, such as parents, teachers, churches, media, and others have taught us that we are small and insignificant and should defer to their “wisdom”.

The truth is that we are powerful beings, if only we would recognize that fact.

The story line of “Illusions Will Fall” takes place in the future after an economic collapse as people adjust to a new reality that sees the fall of centralization and the rise of local economies, institutions,and relationships. This happens as people act from their hearts, realize their own power and mindfully stop giving their power away to others. These are the sounds of resistance.

For more please visit http://www.illusionswillfall.com

Enchantment Begins

This music has a style that combines Pink Floyd, Enigma, and Enya.

This is a sample song from an ethereal rock opera, “Illusions Will Fall”.

Please enjoy, and visit https://avizius.com for more information.

Avizius – Into Other Realms

Music for the mind. You are invited to use this music as a portal

to other realms. Let your mind clear of all unnecessary distractions, relax, breathe deeply, look deep within yourself, and see where your inner self will take you.

This music is presented as a gift for your enjoyment. The album “Into Other Realms” was composed, arranged, and distributed so that others could freely download it, share it and/or use it in their creative works.

This is the “Quiet Time”, Choose Wisely

We are at a fork in the road, the path will no longer go in the same straight ahead direction. We now have to mindfully decide which fork to choose and either choice will take us in a totally new direction. The choice we make will profoundly affect the world we live in. We now have the “quiet time” to reflect and make our choice wisely. One fork or direction is based on fear and competition, the other fork is based in caring and cooperation.

We are at a fork in the road, the path will no longer go in the same straight ahead direction. We now have to mindfully decide which fork to choose and either choice will take us in a totally new direction. The choice we make will profoundly affect the world we live in. We now have the “quiet time” to reflect and make our choice wisely. One fork or direction is based on fear and competition, the other fork is based in caring and cooperation.

The one thing that is certain about the Covid19 pandemic is that the world as we currently know it will no longer be the same after the pandemic passes. There will be tectonic shifts that will overlap in the post pandemic social, political, economic and spiritual realms.

Dramatic changes in any of the above realms rarely happen during periods of comfort and abundance. However during times of crisis or stress people are much more willing to consider ideas or solutions they may not have during the comfortable times. Many people have already encountered an eerie sense of quiet as external circumstances such traffic, activities, and events have been reduced or stopped completely. These “quiet times” can also be internal and often come after a traumatic event such as the loss of a loved one, job, relationship, or some other traumatic event. It is during these “quiet times” that people tune out the external world and enter into a period of deep introspection, and when they emerge, a shift has taken place and things are usually not the same. Some form of metamorphosis has taken place and we emerge as different people. This “quiet time” is a key part of our growth as individuals. This “quiet time” can also be a time of growth and dramatic change for our institutions, governance, and lifestyles.

This “quiet time” can be viewed with either fear or as an opportunity to reflect on life and the people who travel in this life with us. Will you use this time to cower in fear about the uncertainty we are facing or is this an opportunity to spend some quality time with your children, family, and to reconnect with neighbors? What a wonderful opportunity to play board games with your children, take the time to talk, dream, and plan with your spouse, and engage in things that really matter. The earth has sent us to our rooms to take the time to reflect on what we have and have not done.

We were meant to live our lives in joy and share that joy with others. How is it that we were fed the lie that the most important thing in life is all about working for others so we can collect a paycheck? Is your job really the most important part of your life? (This is not to minimize the importance of being able to support your loved ones, but should it be your top priority in life, and perhaps other things are more important? )We have been so busy working at our jobs that we have allowed our powers to be usurped by others in positions of power. This is a time to reflect on this question and come up with the answer that resonates with you.

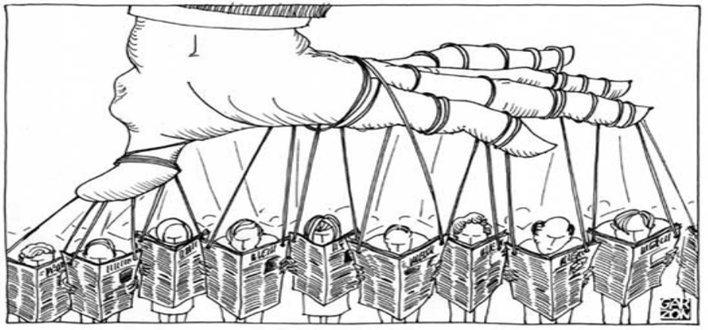

Yet, this “quiet time” is being interrupted by a shrill corporate controlled media seeking to instill fear and divisions between us. It is like someone disturbing a quiet and beautiful scenic park with a megaphone. How can we grow at this important fork in the road when the “quiet time” is being usurped by those with an agenda? The powers that be would certainly prefer to keep us divided and in fear as it serves their purposes. These powers want things to change as well, but not to serve our collective growth, but for their own self-serving purposes.

Some of these changes have already been implemented and the resulting consequences are manifesting themselves. In many states businesses and schools have been forced to close, gatherings have been prohibited, unemployment is rapidly rising, Constitutional rights are being discarded, the bailouts of dozens of privately owned hedge funds, and “shelter in place” mandates that are spreading to more and more areas.

Certainly some of the above changes can be justified in order to slow the spread of the virus, but the question on everyone’s mind should be on how many of these “temporary” changes will become the new normal and stay in place long after the crisis has passed. Consider what happened to your freedoms and rights after 9-11 and the 2008 economic crisis: the grossly misnamed Patriot Act, the wars without end, the constant and expanding surveillance of citizens, secret courts, the taxpayer paid for bailouts of criminal banks, and other examples where fear and hate begat more fear and hate. These changes were implemented during times of fear and are now still with us as permanent features of our political, judicial, economic and social landscape. We need to remain vigilant to make sure this is not repeated. The consequences of not remaining vigilant will be far greater than the consequences of the virus itself.

Do we really want to expand the powers of government and corporations for the illusion of temporary safety? Now is the time to reflect and decide if you want to live in a world of fear and competition or a world of caring and compassion. Living in a society of fear and competition would be a dystopian and Orwellian world.

The structures of our system are rotted and corrupt and would have eventually collapsed on their own even without the virus. The virus has acted as a catalyst. These structures certainly will fall now and will not emerge the same as they were before this crisis. This is inevitable. The question is what will they be replaced with? The fork in the road offers us an opportunity to institute real changes, but will these changes be for the better or for the worse?

The changes that need to take place must happen within us first before they can manifest in the external world. So what can we as individuals do to make sure that we take the fork in the road that will change things for the better?

The key element is not to become consumed by fear. The corporate controlled media is THE key source of disseminating this fear. Will you spend your new “quiet time” with your loved ones or watching the news with its never ending fear mongering? Certainly being informed during this time is important, but do you need to be glued to the TV or computer screen most of the day? Ask yourself: “is this news story designed to keep me informed or to instill fear?” Once you apply this filter to your viewing, you will be surprised how most news stories provide just a little useful information and that most of the content is about fear dissemination.

The economic impacts of this virus will be substantial. Already supply chains that rely on foreign manufacturing are being disrupted. Economic activity has already slowed and unemployment is rising rapidly. The dismantling of local manufacturing and shipping local production to global sources is one of the rotting elements of the current system. Globalization has benefited a small few enormously. What we need now is more localization, not globalization. We need to build resilient local communities that are as self sufficient as possible. Instead of going to a big box store, shop at a local merchant. Since small store has fewer people in it, there is the added advantage of less possible exposure to the virus.

A big box store takes its profits and ships them out of the community, impoverishing it, and often they pay less taxes than small merchants or even no taxes at all. The book “Free Lunch”, by David Kay Johnston explains this in wonderful detail. The local merchant is paying taxes into the local system and profits are recycled back into the community. That 35 cents you saved by ordering from Amazon rather than buying locally enriches one person and makes it harder for the local merchant to survive. Get to know your local merchants by name as they are part of your community family.

Restaurants are one of the segments of our local economies that have been hit hard. You can help that local owner by ordering take-out. You can help by purchasing gift cards. This will provide these owners with immediate cash during these difficult times, while you will be able to enjoy the meals later once the crisis has subsided. We can help other local businesses in similar ways. Talking to owners who may have been forced to close permanently and expressing your sympathies will not help them or your community. Helping them NOW in their time of need will. Your support will be both appreciated and remembered, strengthening the connections in your community.

The most radical thing you can do is to grow as much of your own food as possible. This breaks dependence on corporate food chains and strengthens the community. You will find you have surplus produce and this abundance can be shared with extended family and neighbors. This further strengthens local community connections. Reducing dependence on governments and corporations to the greatest degree possible is a key element in bringing about changes that will benefit the people, not a select few.

Support your local farmers by buying at farmer’s markets. This helps build self sufficiency and resilience into your local community. Many local farmers will allow you to purchase shares on their future production, and this helps them now during the lean planting season and allows the supporting community to share in the abundance at harvest time.

The corporate media has sown divisions among us in every possible way they can. They seek to divide us racially, ethnically, economically, politically, and socially. Is that neighbor who votes for the “other party” really your enemy, or is it those who feed off of and profit from our induced mistrust of others? Isn’t that “other party” neighbor in the same boat as you are? They are also worried about their health, families, and jobs. Get to know your neighbors, and you will find you have far more in common than you have differences. Developing connections with your neighbors will strengthen your community. In the end he may have a tool you need to borrow for some important task. Strong communities will develop local “libraries” of resources that can be shared by all. In the end it is not necessary for every house to have its own ladder, soil tiller, or snow blower. Your neighbor has one and you have the other. Now you have access to both. This is what cooperation looks like.

At the very heart of the rotting system is the current monetary system. It was designed to benefit the few at the expense of the many. If we do not change our monetary system, then we are only nibbling at the symptoms of the problem, not attacking the root cause. We can send a powerful message by removing our money from the Wall Street Too Big To Fail banks. These banks have been indicted multiple times for criminal behavior. Most people would not walk up to a known criminal and say “please hold my money for me”. Yet, so many people ignore corporate criminality and do just that. Why would you trust your money with the same people who have defrauded customers and have reaped obscene profits from gambling with YOUR money, while creating this pyramid scheme that has made the entire economic system vulnerable? Remove your money from the Too Big To Fail banks, and place it in a local bank or savings and loan. Keep the money close to home where it circulates locally serving the community. It is much safer as an added benefit, since small local banks are generally not gambling in derivatives and other leveraged bets.

Start local currencies. This can break dependence on outside money to run a local economy and has been used successfully to stimulate local economies across the U.S. Having people ready to work, people ready to make things, people ready to sell things but not being able to because of a “shortage” of money, is like having an airline with passengers willing to fly, planes ready to fly and full of fuel, and the airline cannot fly because of a scarcity of tickets. This would be considered insanity, and yet this is the current paradigm. Local currencies can fill that “shortage”.

What a wonderful opportunity to take advantage of this “quiet time” to read “Web of Debt”, by Ellen Brown. After this fascinating read, you will never look at money the same way again. It is amazing that people will spend a considerable portion of their life working for those little green pieces of paper with fancy printing on them, and yet have no idea of how that money came into circulation. This book will help you understand this important concept. It clearly lays out the problems with the current system, and provides practical solutions where public banks can work together with community banks to bring prosperity to local communities by eliminating interest payments to Wall Street and keeping the money circulating locally. This has worked well in the past, has worked well in other countries, has worked well in North Dakota, and can work well for our future.

Individually and collectively, we have HUGE power that can bring about needed changes at this time. Whenever you give someone your money, you are turning over some of your power to them. This power is cumulative and can result in wealth and power extremes. Once we become mindful of to whom or to what corporation we give our power to, we can take back control of our own destinies. There is no need to confront the forces working against us, we can simply make them obsolete and they will wither away on their own. Every time you are ready to purchase something, consider carefully who you are giving your power to. It matters.

Pay in cash or local currencies as much as possible. The Too Big To Fail banks charge merchants an average of 3% of every transaction. This money leaves your community and enriches the Wall Street banks where the current paradigm is to privatize profits and socialize losses. Buying something with cash is one of the few things left you can still do anonymously. Buying with any form of digital currency, or credit cards by design allows the transaction to be tracked by government and corporations. If we do not use cash, we will lose it and the control that will be given to the powers that be will be complete. Do your own research on the dangers of a cashless society.

All of the above actions can be done relatively easily by being simply aware and mindful. We have power to influence the direction the changes that are coming will take. These changes start with the individual, extend out to the family, the neighborhood, and out into the community. We now have the “quiet time” to maintain vigilance at what the powers that be are attempting to do,. It is our responsibility to make sure they do not overreach. Your inner voice or intuition will tell you what is right and what is not. Have the courage and wisdom to listen to it.

So, here we are at the fork in the road. The choices we make will profoundly affect the world we live in, and we now have the “quiet time” to reflect and make those choices wisely. The changes we make within ourselves will be reflected in the reality in which we live.

One fork or direction is based on fear and competition, the other fork is based in caring and cooperation. Which direction will you take?

Time To Eliminate Your Wall Street Tax?

As we get older, and hopefully wiser, we generally start to become more discerning on how we view the world and the problems we face. Many of us who seek to make the world a better place try to look at the problems, analyze them, and do what we can to correct them. However, because there are so many different problems facing us, this approach often overwhelms us and can instill a sense of hopelessness in our ability to create positive change.

As we get older, and hopefully wiser, we generally start to become more discerning on how we view the world and the problems we face. Many of us who seek to make the world a better place try to look at the problems, analyze them, and do what we can to correct them. However, because there are so many different problems facing us, this approach often overwhelms us and can instill a sense of hopelessness in our ability to create positive change.

Looking more deeply into this situation, we discover that many of these difficulties are SYMPTOMS of much deeper problems, and that attempts to address these SYMPTOMS are not an effective or efficient way to bring about the changes we desire. One can compare this to having abdominal pains and visiting a doctor who offers you pain killers without investigating the underlying cause of the pains being experienced. If the pain is the result of a cancer or an ulcer, then the pain is only a SYMPTOM, not a ROOT CAUSE. Treating the SYMPTOM in this case is not an effective or efficient way to address the problem. It may bring about temporary relief, but ignores the ROOT CAUSE.

A similar situation exists when we look at the wide range of issues we face as a society. Some of the issues include homelessness, lack of medical care, unemployment, high debt loads, widening wealth gap, declining schools, infrastructure neglect, fraying safety net, increasing government fees and tolls, etc. Trying to address each one of these issues individually becomes an overwhelming task. These issues are not ROOT CAUSES, but SYMPTOMS.

If we take time to ponder and analyze each of these issues looking for a common thread, one can determine that they are all the result of money, more specifically the lack of money. This process starts getting us closer to the ROOT CAUSES.

So how is it that as a society we can work so hard and still experience this lack of money?

Consider this…. If you have a given amount of money in your possession or control, all of that money is available to you to spend. Once you give some of that money to someone else, it is no longer available to you and is now available to others. While this concept may seem to be quite elementary, this is the basis of where much of the problem lies. If one applies the same principle to a larger group such as a family, a community, a county, state and even nation, the result is still the same. Once money leaves the group, it is no longer available to that group. Understanding this brings us another step closer to the ROOT CAUSES.

Most homeowners can relate to this. Let’s suppose that you have taken out a mortgage for $100,000. By the time you have completed paying off your mortgage, it will probably have cost you well over $200,000. The cost of the interest payments exceeds the original cost of the home. These interest payments are money that you and your family no longer have to spend on your needs.

The same principle applies when a school district, municipality, county or other entity wishes to do a repair, a capital improvement or infrastructure project. The costs of these projects can easily double or even triple due to the interest charges. It almost seems insane, but we pay more to the financiers of these projects than to those who provided the materials and labor for the project. This does not even include the fees imposed by the bank on the borrowers. Now we are approaching the ROOT CAUSES.

In California, the long awaited new Bay Bridge span was recently completed at a cost of $6.4 billion, which was 4 times over the initial projected costs. What most Californians don’t realize is that the total cost of the bridge will eclipse $13 billion when interest payments are considered over the life of the loans or bonds. So when we talk of projects costs doubling or tripling, it is not hyperbole.

So exactly where does all this interest and fee money go when it leaves the community?

It flows to the big Wall Street banks, enriching them, while impoverishing the community. This is the “Wall Street Tax” that effectively doubles or triples the cost of every project across every community in the nation. It is YOU, the taxpayer who pays this tax. Once the money leaves the community, it can no longer circulate locally and is no longer available to the community, exactly as described in an earlier paragraph. This is a ROOT CAUSE of why so many communities are struggling. To add insult to injury, these big Wall Street financiers are not even using their own money, they use other people’s money so they can skim the interest payments to line their own pockets. We have all seen how Wall Street has prospered since the 2008 crisis, while Main Street has been left to languish.

So why do school districts, municipalities, counties and states (we’ll just refer to them as “communities” from this point on) use these big Wall Street financiers to fund their projects? It is because the costs of these projects usually exceed the ability of small local community banks to finance them. Additionally, because of capital requirements, the deposits of these communities can not be handled by the smaller local banks leaving only the big banks capable of handling such large deposits and transactions.

This means that even the deposits of these communities which can include tax revenues, payrolls, and pension funds, are deposited with the large banks and therefore also shipped out the community,. These funds are then “invested” by Wall Street anywhere in the world where they can obtain the highest return. These funds are not being used to invest in local needs. This is another ROOT CAUSE for why Main Street has been struggling, while Wall Street has been thriving.

With the current banking system we have witnessed the largest concentration of wealth in human history, while the vast majority of people have experienced stagnant wages, declining wealth, and recurring recessions.

Maybe it is time to engage in some “out of the box” creative thinking? Wouldn’t it be wiser for communities to be able to obtain local funding at reduced interest rates where any interest payments would remain in the community and get recycled? Any good businessman would tell you that it is sound business to eliminate any middleman in a business transaction. Wall Street is nothing more than a middleman between funding and community needs, and if the Wall Street middleman was eliminated, more money would remain in our communities. How could this be done?

There is another way to finance public projects and it is already happening across the world and in the state of North Dakota. North Dakota has its own public bank, the Bank of North Dakota. This bank has been in existence for a century and provides communities and businesses with low cost loans. Some examples of this: A new business in North Dakota can get a 1% loan for 5 years, student loans are available at below market rates with no bank fees, no town or county in ND has or needs a “rainy day” fund, they instead have the Bank of ND where they can obtain low interest loans should an emergency arise.

The Bank of ND does not compete with community banks, but rather partners with them. There is a correlation between this partnering and the fact that North Dakota has the largest number of community banks per capita of all states in the nation. Additionally, the Bank of ND has only one office and no branches, no tellers, and no ATMs that compete with community banks.

This partnering with local community banks means that the Bank of ND does not lend directly to small local businesses, but relies instead on the local community banks to originate those loans. The public state bank can provide funding beyond the deposit base of a small community bank allowing the community bank to finance projects it could not have financed without the partnership. If a local bank had a $5 million limit, and a business wanted $10 million for a new showroom, the bank would have to say no to the loan, forcing the business to go to a Wells Fargo, Citi, JP Morgan Chase or other large Wall Street bank. This results in the loss of business for the community bank. With the public state bank, the community bank could partner on the loan, raising its loan ceiling, retain the money in the community, and provide the services needed.

One very important issue that needs to be raised is that of the safety of the loans being made. It is important to be sure that bank loans are made to people and entities that are truly credit worthy. In North Dakota there is a double check on this process. Any loan that a community bank requests a partnership with would require approval by both the community bank and the state bank officers, since both would be providing the funds. This results in a lower default rate as two sets of eyes are examining and approving the loan.

There are those who may say that a state public bank could be at risk of failure and may need to be bailed out by the taxpayers. This was an issue that created much anger during the 2008 crisis. However, the Bank of ND was properly managed and did not need a bail out and in fact returned a profit of millions that year and every year since then to the state treasury. Politicians on BOTH sides of the aisle in the North Dakota Legislature love and support their state bank! How common is that?

The proper management of the Bank of ND can be attributed to the fact that the officers of the bank receive appropriate salaries (far less than their Wall Street counterparts) and have no bonuses and therefore no incentives to take on excessive risk. The private Wall Street bankers are pressured by their shareholders to return high profits, which often leads to excessive risk taking rather focusing on the economic growth of the state and nation. Some of these investments could possibly be for things the community would not support or would even work against the best interests of their community. The public bank is required by its owners, which would be the people, to invest wisely to promote the economic vitality of the community.

The prosperity created by keeping deposits locally and recycling the fee and interest money locally, would create new jobs, new businesses, fund “wish list” projects, and as a result would raise tax revenue. As more businesses thrive, the tax base and ratables would became larger, which could possibly contribute to tax cuts.

A public bank is not limited to only states. Municipalities and counties could also form their own. There are public banks being considered in New Jersey, Philadelphia, Santa Fe, Vermont, California, Seattle, Los Angeles, Oakland, San Francisco and other places. These public banks have the ability to transform how communities obtain funding. It will keep deposit and interest money circulating locally and out of the hands of Wall Street, thus enabling our local communities to thrive.

I would encourage readers to do their own research and discover how a public bank can tip the balance towards Main Street, rather than Wall Street, and help their small community banks at the same time. A good place to start is with the Public Banking Institute. Perhaps this is a good time to eliminate the Wall Street Tax that you are paying.

On Thursday April 6, 2017 two world-renowned economic thinkers, Michael Hudson and Ellen Brown, came to Franklin & Marshall College in Lancaster, PA to discuss how a public banking option can affect governmental effectiveness. This discussion was moderated by Walt McRee, the chair of the Public Banking Institute. This discussion which was open to the public focused on the key differences between government’s unquestioned reliance on private capital markets and how an entirely new, more productive arrangement could be devised. Kudos to Franklin & Marshall College for providing their students and community with such a high caliber seminar. The following video is that discussion.

Journeys

Life takes everyone on journeys…

The journeys may be spiritual or literal…

As we journey, we grow…

As you change, so does the world

Break Out of the Illusion

In the old Soviet Union, people had “free” elections and were “free” to choose any Communist candidate that had been selected for the election. Most of the people of the Soviet Union understood well that their elections were shams.

Here in the United States, we also have “free” elections and the corporate media narrative is that you need to vote for one of the two candidates that have been selected for you, because if you go outside of that “choice”, the other terrible candidate that you do not want will win the election. You may not particularly like the candidate you plan to vote for, but that candidate is certainly the “lesser evil”. The corporate media has successfully spun that illusion so now many people do not even realize that there are choices outside of the Democrat/Republican duopoly that is strangling our election process.

So exactly how has the media created this illusion? Here are 2 examples:

Peoples’ Exhibit A:

In Maryland, there are 3 candidates that are on the ballot for the office of U.S. Senator. Logically, you would think that the televised debate to inform voters of all their choices that the televised debate of these candidates would therefore include all three candidates. Unfortunately, you would be wrong.

Only the candidates representing the Democrat/Republican duopoly were allowed to appear on stage, censoring the voice of Dr. Margaret Flowers, who is running on the Green Party ticket. This was done despite the fact that both of the candidates clearly said that Dr. Flowers should participate in the debate. (Notice how it was the corporate entities that dictated who appeared and who did not). The Republican candidate Kathy Szeliga, openly suggested that the third podium be opened for Dr. Flowers to participate, yet she was ignored. THIS IS KEY: what does this tell you of the real power structure here?

The YouTube video below will show Dr. Margaret Flowers boldly going on to the stage and challenging the censoring of her voice. (Things start getting interesting around 5:50) Once you have seen this video, what are your thoughts about how “free” our elections really are? Do you like the fact that the corporate media gets to make the decisions of who should be heard and who should not?

Additional information can be found on Dr. Flower’s FaceBook page:

https://www.facebook.com/flowers4senate/?fref=ts

After being ejected from the stage, Dr. Flowers issued a statement:

“We are fighting for our families, and our communities. I will not be silent about this rigged political process and this televised sham debate I was just excluded from.

Shame on Ralph Watkins of League of Women Voters, Andy Green of the Baltimore Sun, Jay Newman of WJZ-13 CBS Baltimore, Ann Cotten of The University of Baltimore, and thanks to Kathy Szeliga, all the brave voices that rose to speak up, and everyone sharing the word on social media.“

People should find it especially troubling that institutes of higher learning, the University Of Baltimore and the College of Public Affairs were engaged in the censorship of a candidate who was on the ballot, but outside of those selected for public consumption. What ethics, morals, and values are they teaching their students and our future leaders? As a student or a parent of a student attending the University of Maryland, I would be very concerned about the leadership of this institution. Should not the very purpose for the existence of the College of Public Affairs be to engage in uncensored free debate of ideas? How can they be a party to the limiting and censoring of ideas? As a student attending these schools, I would certainly be reevaluating my enrollment. This is a purposeful dumbing down of the curriculum and this school could eventually find itself losing its relevancy, much as the public distrust for the corporate media has been steadily and continuously eroding their relevancy.

Additionally, the reputation of the University was further damaged by the fact that the University of Baltimore refused to meet with Dr. Flowers and that it was the University Police that forcefully escorted Dr. Flowers from the debate.

This entire episode illuminates how “our” electoral process has been hijacked by corporate interests and others who serve those interests. The fact that the Maryland League of Women Voters were integrally involved in this silencing saddens the heart. Here is an organization that previously had tremendous integrity, but has over time been co-opted and now serves the power interests.

Peoples’ Exhibit B:

Remember those presidential debates? They only included Clinton and Trump, despite the fact there are two other candidates on the ballots in most states. Gary Johnson of the Libertarian Party and Jill Stein of the Green Party were not part of these debates. Who was it that excluded them?

They were excluded by the Commission on Presidential Debates. So who exactly is this Commission on Presidential Debates?

Most people would be surprised to learn that the Commission on Presidential Debates (CPD) is a private corporation. It is under the joint sponsorship of both the Democratic and Republican political parties in the United States. The Commission’s debates are sponsored by private contributions from foundations and corporations. It becomes easy to understand why such a corporation would want to exclude candidates from other political parties that would question the existing power structure.

With the CPD being privately funded by big money, just whose interests do you believe that the CPD represents? If they were to allow outside political parties to participate in the debates, the illusion that they have spun through their mouthpieces in the corporate media would begin to unravel. People would realize that there are other choices beyond the “lesser evil”.

The sad part is that most people I talk to have not even heard of Gary Johnson or Jill Stein. Despite the fact that Trump and Clinton are the most unpopular candidates in recent history, the campaigns of Johnson and Stein do not get any traction in the corporate media. So exactly how has the corporate media provided the people with unbiased and neutral information?

When was the last time the corporate media news presented you with a contrast and comparison of the candidates’ positions on the issues? When was the last time the corporate media presented you with the voting records of all the candidates on specific issues? When was the last time the corporate media presented you with information on who contributed to the candidates? Corporations and big money do not want you knowing this information about their hired and paid for servants. What we have received from the corporate media is mud slinging, scandals, and basically a horse race mentality of who is ahead and who is behind in corporate run polls. A substantive discussion of the key issues affecting the nation and the planet has been missing. It is the corporate media that is limiting your information and choices, and yet most people still unquestioningly accept the “lesser evil” paradigm constantly repeated by these self-serving entities.

In Summary

When you look how the how the Supreme Court essentially legalized government corruption through its infamous Citizens United ruling, when you see how big money has flooded the electoral process, when you witness the forceful ejection of a candidate by corporate interests from a televised debate, when you see big money and corporations essentially bidding for government favors, it becomes apparent that we have a corporate state with a government that services its needs.

The corporate media is used as a tool to make sure that the current power structure stays in place. Just look at the revelations by WikiLeaks, (an alternative media site) on how the corporate media was used to favor establishment candidates during the primary elections. Isn’t it interesting that these WikiLeaks documents also did not get much corporate media attention? People are forced to go to alternative media to obtain this information. These leaks will most certainly be used by historians to write about this corrupt 2016 election.

The corporate media is used as a tool to make sure that the current power structure stays in place. Just look at the revelations by WikiLeaks, (an alternative media site) on how the corporate media was used to favor establishment candidates during the primary elections. Isn’t it interesting that these WikiLeaks documents also did not get much corporate media attention? People are forced to go to alternative media to obtain this information. These leaks will most certainly be used by historians to write about this corrupt 2016 election.

The fact that the corporate media excluded candidates on the ballot from the televised debates should not surprise anyone as it would have disrupted the illusion of having only two choices in the election. As we saw in the debates, the power resided not with the political candidates, but with the corporate interests. What would you expect from such a media when you have a Green Party that accepts no corporate donations.

It is time to break out of the illusion that has been spun by the corporate interests. Take a good hard look at the platforms of Gary Johnson and Jill Stein. You may just find that they represent the values, ethics, and morals that you really believe in. Take a look at the platforms of other candidates further down on the ballot. Do not allow yourself to fall for the “lesser evil” paradigm that has been repeated over and over again. The Democrat/Republican parties are all part of the same Money Party. As long as we keep rewarding them with our votes, what incentive is there for them to change?

In case anyone reading this still thinks their elected officials are representing them, what do you think would happen if you and a lobbyist were waiting to see your elected representative, who would be seen first?

You can expect that the corporate media will keep repeating the refrain that you are throwing your vote away if you vote outside of the duopoly. But try to explain to yourself how you are not throwing your vote away by voting for someone you do not want? Look where generations of voting for the “lesser evil” has brought us.

So I leave you with this parting thought: exactly just how is our electoral system different from that in the old Soviet Union? Both the USSR and the US preselect the candidates offered to the masses and suppress those outside of the power structure.

There is an old saying: “as long as you keep doin’ what you are doin’, you will keep gettin’ what you are gettin’ ”. It is time to End The Illusion.

Highwaymen Motorcycle Club – Highwaymen MC

After a long absence, I have returned to blogging. I believe that this article is probably not what regular visitors to this site would expect to find, but it is a story I wished to have told. You can double-click on any of the images to see the full size version.

After a long absence, I have returned to blogging. I believe that this article is probably not what regular visitors to this site would expect to find, but it is a story I wished to have told. You can double-click on any of the images to see the full size version.

I recently surfed the Internet and decided to look up a Jersey Shore motorcycle club called the “Highwaymen”. The reason for this, was that I was a member of that club during the late 60’s and early 70’s and I just wanted to see what posterity would have to say about this organization. I also want to add at this time, that the Highwaymen from the Jersey Shore were not affiliated with other clubs with the Highwaymen name across the nation.

To my dismay, after spending much time searching, there was absolutely nothing about them anywhere on the Internet. It was as if this group, which at that time was such an important part of my life had never existed. While the “footprint” of the group was local, and not as wide as the larger clubs, I feel that to have this memory erased from history would be a loss. Since this group was not written about, there was no record, it stood to reason that this memory would therefore be lost to time. I am sure that there are many people from the shore area that would remember The Highwaymen from many Long Branch and other shore area bars, the social scene, the protests, and from the Windmill on Ocean Ave where we would often assemble before our rides. So I am writing this one article just so the memory is preserved and so that some our interactions with the people of the shore area as well as the other motorcycle clubs of that time are documented.

The Highwaymen started sometime around 1967 with a group of motorcycle riders mostly based in the shore town of Long Branch, New Jersey. I joined the club in mid 1968. Our numbers varied from a low of 6 members to a high of 23. We were a club that liked to ride a lot and we often had runs (rides) to some beautiful sites in New Jersey, Pennsylvania, Maryland and other surrounding areas where we would often party and camp overnight. (Yes, New Jersey does have some great sites as well as plenty of wonderful camp grounds.) Our parties were always a good time and since we often stayed overnight on our runs, we did not have to worry about getting too wasted. Of course, the cops at that time were much more relaxed about these sort of things than they are now.

The Highwaymen started sometime around 1967 with a group of motorcycle riders mostly based in the shore town of Long Branch, New Jersey. I joined the club in mid 1968. Our numbers varied from a low of 6 members to a high of 23. We were a club that liked to ride a lot and we often had runs (rides) to some beautiful sites in New Jersey, Pennsylvania, Maryland and other surrounding areas where we would often party and camp overnight. (Yes, New Jersey does have some great sites as well as plenty of wonderful camp grounds.) Our parties were always a good time and since we often stayed overnight on our runs, we did not have to worry about getting too wasted. Of course, the cops at that time were much more relaxed about these sort of things than they are now.

This is one of oldest pictures I have of a Highwayman party. This was when our patch was a crown, not the highwayman in flames that replaced it. The older members of the club later placed these patches on the front of their colors and were known as ‘crown members”.

You may notice the amplifier being used for the music is a vacuum tube amplifier (old). We had rented this house out as a temporary club house in Allenhurst, but I guess the landlord didn’t like parties as much as we did and we ultimately had to leave. However, it did serve its purpose for one very cold winter.

One of our favorite locations of the runs we used to take was to visit the Delaware Water Gap on the Pennsylvania-New Jersey border in the northern part of NJ. We found a a farmer’s field right next to small river that during certain times of the year was basically unattended. Here we could camp out, party, and go swimming during hot days. (OK, I admit we were probably trespassing, but I can write about it now because the statute of limitations has probably kicked in almost 4 decades later).

One of our favorite locations of the runs we used to take was to visit the Delaware Water Gap on the Pennsylvania-New Jersey border in the northern part of NJ. We found a a farmer’s field right next to small river that during certain times of the year was basically unattended. Here we could camp out, party, and go swimming during hot days. (OK, I admit we were probably trespassing, but I can write about it now because the statute of limitations has probably kicked in almost 4 decades later).

This wonderful location was within easy driving distance to the most scenic areas, best bars and good food places. The main reason I am mentioning this area is because we did not take many group shots or even photos of our activities, and the best pictures I have are from these runs. The image to the left was the very first ride we took to this location when a small group of us were exploring the area. From left to right: Patty, Crash, Rudy, Momo, Spider, Joline, Gypsy, Patty, and kneeling Spike, Mary. The spot was so perfect we resolved to bring others the next time we came.

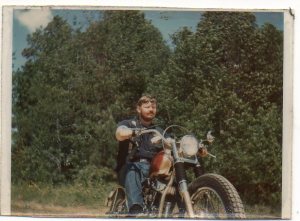

We had 3 presidents during the life of the club, Gypsy, Bear, and Zee. The picture to the left is Bear, just before he was shipped off by the army. He left for his home in North Carolina before he was finally shipped off to Europe. He was sadly missed and unfortunately never returned after leaving. I actually ended up buying his bike which he is riding in this picture. The military draft played a large role in the changing membership of the club. We lost people to the draft, many returned after serving, and we also had several members in the club from the military who were based in Fort Monmouth. Some of the Ft. Monmouth members I recall included Bitch from Iowa, TC from Missouri, and Satch from Pennsylvania. When Satch left the military and returned to Pennsylvania, he briefly started a chapter of the Highwaymen in West PA.

We had 3 presidents during the life of the club, Gypsy, Bear, and Zee. The picture to the left is Bear, just before he was shipped off by the army. He left for his home in North Carolina before he was finally shipped off to Europe. He was sadly missed and unfortunately never returned after leaving. I actually ended up buying his bike which he is riding in this picture. The military draft played a large role in the changing membership of the club. We lost people to the draft, many returned after serving, and we also had several members in the club from the military who were based in Fort Monmouth. Some of the Ft. Monmouth members I recall included Bitch from Iowa, TC from Missouri, and Satch from Pennsylvania. When Satch left the military and returned to Pennsylvania, he briefly started a chapter of the Highwaymen in West PA.

The next ride we took to “our spot” by the Delaware Water Gap took place about 1 year later. It was a fantastic ride and with a great time swimming, drinking, and just carrying on. In the picture on the left, from left to right: Momo, Rudy, Rasa, Stiff, Crush (with helmet), Spook, Gypsy, Skrinky, Babo, Evil, Muskie and Yank. Yank was drying his underpants on his head so he did not have to wear wet underwear. The picture to the right from left to right: Stiff, Spook, Gypsy, Muskie, Skrinky (with hat), Yank (lying down), Evil, Zee, and Rudy.

As a club we had contact with other clubs in the area including Branded MC, Breed MC, and Pagans MC. We considered Branded MC to be our “sister club” and we had many great parties with them and great meetups at some bars in Atlantic Highlands. The picture to the left is the only picture we have of them and we were meeting to go on a joint run to the Cape May area. We also attended many parties with the Breed MC in Jackson Township, and once in Staten Island. The Highwaymen MC also partied with the South Jersey chapter of the Pagans MC.

As a club we had contact with other clubs in the area including Branded MC, Breed MC, and Pagans MC. We considered Branded MC to be our “sister club” and we had many great parties with them and great meetups at some bars in Atlantic Highlands. The picture to the left is the only picture we have of them and we were meeting to go on a joint run to the Cape May area. We also attended many parties with the Breed MC in Jackson Township, and once in Staten Island. The Highwaymen MC also partied with the South Jersey chapter of the Pagans MC.

We had many of our own great parties and the picture on the right is from one of them. I believe that this was a New Years Eve party. The house location of this was practically right on the beach and the site of other good parties. We had a live band playing that night. We actually had a college fraternity party going on next door, and many of its attendees left that party and ended up at our party. From left to right: Spike, Fast Eddie, Gypsy, Rudy.

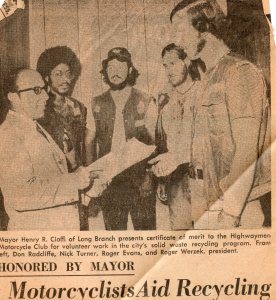

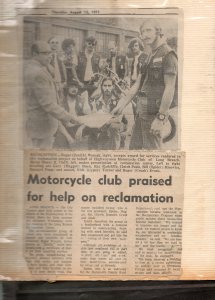

In order to maintain good relations with the locals, as a club we decided that it would be good public relations if we helped the township with its new efforts at recycling. This was one of the first recycling efforts in NJ and our efforts provided the labor needed to keep it running. Once a week we would help in the effort and it was successful at reducing any animosity the local police had towards us.

In order to maintain good relations with the locals, as a club we decided that it would be good public relations if we helped the township with its new efforts at recycling. This was one of the first recycling efforts in NJ and our efforts provided the labor needed to keep it running. Once a week we would help in the effort and it was successful at reducing any animosity the local police had towards us.

Upon reflection, I take pleasure in the fact that we helped to launch the recycling movement that would eventually be adopted by most municipalities across the country. Our efforts were recognized by 2 local newspapers, and we were guests of honor at a symposium held at Monmouth College.

After approximately 4-1/2 years in existence, in December 1971 the club decided to disband. We met on a cold night on a deserted beach in Long Branch, and all records, secretary’s notes, logs, rockers, and patches were burned in a bonfire and we had a few final drinks together as a club. Those who were current members in the club kept their colors. It was sad, but it was the right thing to do and it was the right time to do it. I did find it ironic that the police showed up to this final “meeting” and actually wrote down our information for their records, — on the same night that we were disbanding. Over time, many of the former members stayed in the Jersey Shore area, but most left for other areas or states.

As a final postscript: in Spring 2012, several of the members had an informal reunion 4 decades after the club had disbanded. We met at the Brighton Bar in Long Branch, one of our old hangouts which is still is business. It was nice to get together with the brothers we once rode and partied with. From left to right: Yank, Zee, Spook, Skrinky, Woody, and Rudy.

You can click on any image to see it full size.

So there it is. This small group of fun loving riders from the Jersey Shore now have a written record so they will not be forgotten forever, and can be a footnote for the Long Branch Historical Society.

I am personally still riding. I have a Harley Shovelhead along with my wife who also has her own Shovelhead. You can still find us patronizing some of the finest watering holes in South Jersey.

I am personally still riding. I have a Harley Shovelhead along with my wife who also has her own Shovelhead. You can still find us patronizing some of the finest watering holes in South Jersey.

If anyone has additional photos or stories they want to share, please contact me by filling out the form below, your email will never be shared with any outside people or groups:

You Know A Politician or Talking Head is Clueless When…

Often you watch TV and some politician or talking head starts spouting on some subject as if they are an expert in that field. It is easy to be taken in unless you are knowledgeable in that subject. This video is on a subject that affects everyone and after watching it, you will be able to spot a clueless politician or talking head.

Prosperity for Main Street, not Wall Street

The key reason that communities are struggling is the huge burden of interest payments that are flowing to the big banks. Think about this, if you buy a home for say $100,000 dollars, typically you will have paid $250,000 once the loan is paid off. This means the typical loan will incur $150,000 in interest charges.

The same concept applies when a community builds an infrastructure project such as school, road, bridge, sewer or other project. That $1 million dollar school could end up costing taxpayers in the community $2.5 million after interest charges.

So taxpayers are paying more to the financiers of the project than to those who supplied the materials and actually did the labor to build it. Are you OK with them acting as a middleman sucking prosperity from our communities? Any good business model dictates the efficiency of eliminating middlemen.

If we look at cities like Detroit and Philadelphia, hundreds of millions of dollars in interest payments and fees are leaving the city and flowing into the coffers of Wall St. This lost money impoverishes your community while Wall St gets bigger and richer than ever. The video below describes a solution to this problem.

The research uncovered a compound called Deacon 8875, which is a heat curing fibered paste for high-temperature flange sealing and gasket dressing applications. This is a sealant / refractory hybrid that does not become weak or brittle, and is not affected by the thermal cycling that would be associated with the normal heating and cooling of motorcycle exhaust pipes. It has temperature range: 500°F to 1800°F, which is below the operating temperature of motorcycle exhaust pipes. This product comes with comprehensive information and safety handling sheets.

The research uncovered a compound called Deacon 8875, which is a heat curing fibered paste for high-temperature flange sealing and gasket dressing applications. This is a sealant / refractory hybrid that does not become weak or brittle, and is not affected by the thermal cycling that would be associated with the normal heating and cooling of motorcycle exhaust pipes. It has temperature range: 500°F to 1800°F, which is below the operating temperature of motorcycle exhaust pipes. This product comes with comprehensive information and safety handling sheets.

Now, there were other products that were also considered that are available and they may also accomplish the sealing of the exhaust pipes. One was Deacon 8875 Thin. This product was considered because it comes in a tube that fits into a caulking gun and costs about $38 which is significantly cheaper than the quart can. I also liked how it would probably be easier to apply than the Deacon 8875. The reason it was rejected was because it lacked the fibrous filler material of the Deacon 8875. I was concerned the Thin version might not fill flange gaps as well.

Now, there were other products that were also considered that are available and they may also accomplish the sealing of the exhaust pipes. One was Deacon 8875 Thin. This product was considered because it comes in a tube that fits into a caulking gun and costs about $38 which is significantly cheaper than the quart can. I also liked how it would probably be easier to apply than the Deacon 8875. The reason it was rejected was because it lacked the fibrous filler material of the Deacon 8875. I was concerned the Thin version might not fill flange gaps as well.